Palantir Technologies (PLTR), the poster child of the artificial intelligence (AI) revolution, has found itself at the center of a storm stirred by none other than Michael Burry. Yes, that Michael Burry, the man who bet against the housing market in 2008 and walked away with a fortune while the rest of Wall Street went up in smoke.

This time, Burry’s Scion Asset Management dropped jaws with a $912 million put option position against Palantir. 5 million put contracts is no small whisper of doubt. His move came right after his cryptic caution to retail investors about the bubble-like exuberance floating around AI stocks.

For the uninitiated, a put option gives the holder the right to sell a stock at a pre-decided price, implying that Burry is expecting PLTR stock to head downhill. Now, the twist is that Palantir, fresh off record earnings, watched its stock nosedive 7.94% on Nov. 4 after the filing went public and the company reported quarterly results.

Palantir’s CEO Alex Karp was not having any of it. He fired back, calling the short bet “absurd” and “bats--- crazy,” standing firm on Palantir’s dominance in the AI universe.

The tension is palpable. One side is betting on the fall of a tech titan, the other is swearing on its rise. The real question, though, is where investors stand when titans clash. Let us peel back the layers of this story and see which side of the trade time will prove right.

About Palantir Stock

Palantir Technologies, headquartered in Denver, Colorado, is a data powerhouse redefining how the world processes information. Holding a market cap of nearly $415 billion, its software platforms, Gotham, Foundry, and the AI-driven AIP, have become indispensable tools for governments, militaries, and corporations.

Despite seeing a recent drop, shares of PLTR have performed well over the longer term. Over the past 52 weeks, PLTR shares have skyrocketed 207%. Even the last six months alone brought a sharp 55.4% surge.

Palantir’s valuation has reached stratospheric levels, trading at 384 times forward earnings and 155 times sales, vastly exceeding industry norms. Such multiples suggest investors are paying an extraordinary premium, one rarely seen since the dot-com bubble. So, even though Palantir delivered blockbuster earnings, the stock recently tumbled as markets questioned whether its growth truly justifies this sky-high price tag.

Palantir Surpasses Q3 Earnings

On Nov. 3, just a day before the selloff, PLTR shares climbed 3.4% to hit a fresh 52-week high of $207.52. The rise came on the day the company unveiled its fiscal 2025 Q3 earnings. Revenue surged 62.8% year-over-year (YOY) to $1.18 billion, breezing past analyst estimates of $1.09 billion.

The U.S. business alone expanded 77%, while the U.S. commercial segment soared 121%. The company closed 204 deals worth at least $1 million, 91 deals above $5 million, and 53 deals crossing $10 million. Its total contract value hit a record $2.76 billion, a 151% YOY jump.

The bottom line followed suit. Adjusted EPS climbed to $0.21, beating Wall Street’s $0.17 estimate. Management, brimming with confidence, raised guidance for the next quarter and the full year. For Q4, Palantir expects revenue between $1.327 billion and $1.331 billion and adjusted operating income of $695 million to $699 million.

For the full fiscal year 2025, the company is projecting revenue between $4.396 billion and $4.400 billion. Even more impressive is the optimism around its U.S. commercial segment, expected to grow over 104% to exceed $1.43 billion. Adjusted income from operations could range between $2.151 billion and $2.155 billion, while free cash flow is pegged between $1.9 billion and $2.1 billion.

Analysts are also bullish on earnings growth. They predict fiscal 2025 Q4 EPS could jump 1,800% YOY to $0.17, and the full-year bottom line could rise 550% to $0.52. For fiscal year 2026, projections point to another 52% jump from the previous year to $0.79.

What Do Analysts Expect for Palantir Stock?

Analysts, ever the cautious realists, are watching Palantir’s saga with mixed emotions.

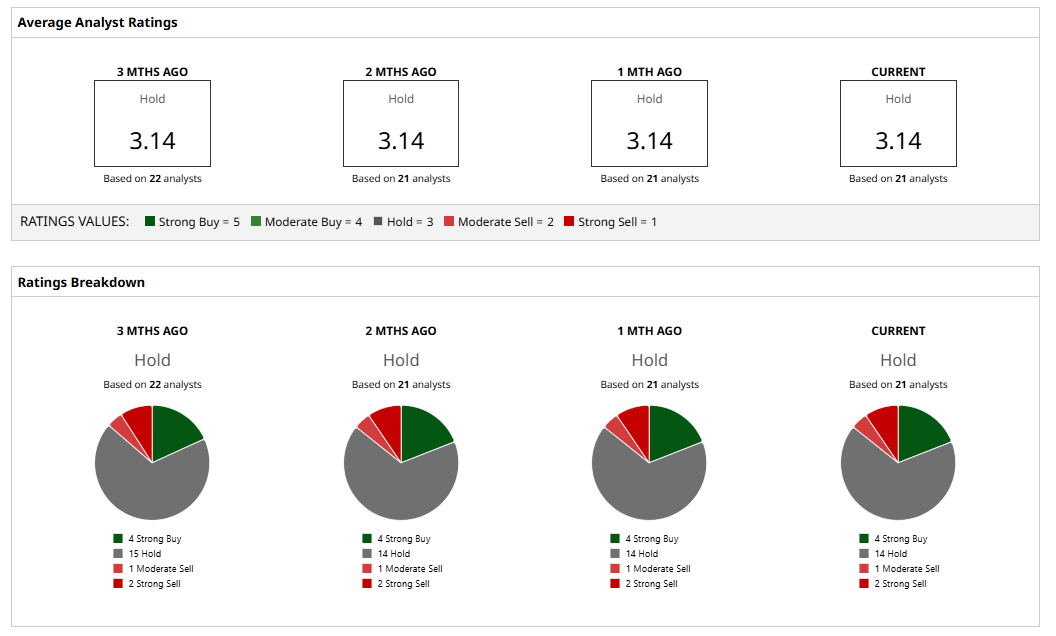

As of now, the consensus rating hovers at a “Hold.” Among the 21 analysts tracking PLTR, four label it a “Strong Buy,” 14 suggest “Hold,” one advises “Moderate Sell,” and two call for a “Strong Sell.” The stock trades 13% below its average price target of $191.44.

Meanwhile, the Street-high target of $255 from Bank of America reflects a potential gain of 50% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Is Betting Against Palantir Stock. At Least 1 Analyst Thinks It Can Gain 50% from Here.

- Why Is Everyone Watching Palantir Stock?

- The Saturday Spread: How the Game of Baseball Can Be Used to Effectively Trade Options

- Core Scientific Just Rejected CoreWeave’s Bid. Should You Buy CRWV Stock Here or Stay Far Away?