Rivian has been treading water for the past six months, recording a small loss of 3.8% while holding steady at $13.92. The stock also fell short of the S&P 500’s 9.7% gain during that period.

Is now the time to buy Rivian, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in Rivian. Here are three reasons why you should be careful with RIVN and a stock we'd rather own.

Why Is Rivian Not Exciting?

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

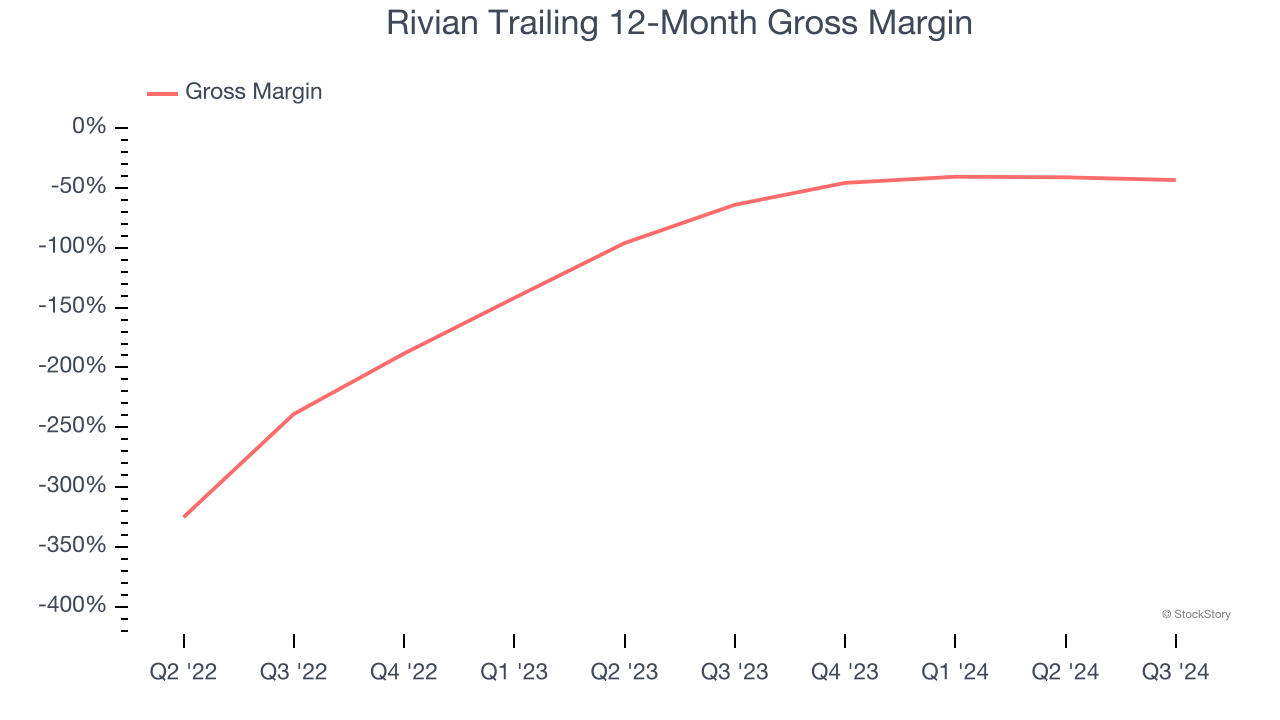

1. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Rivian has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants whose fleets are too young to generate substantial aftermarket revenues have negative gross margins. As you can see below, these dynamics culminated in an average negative 74.5% gross margin for Rivian over the last three years.

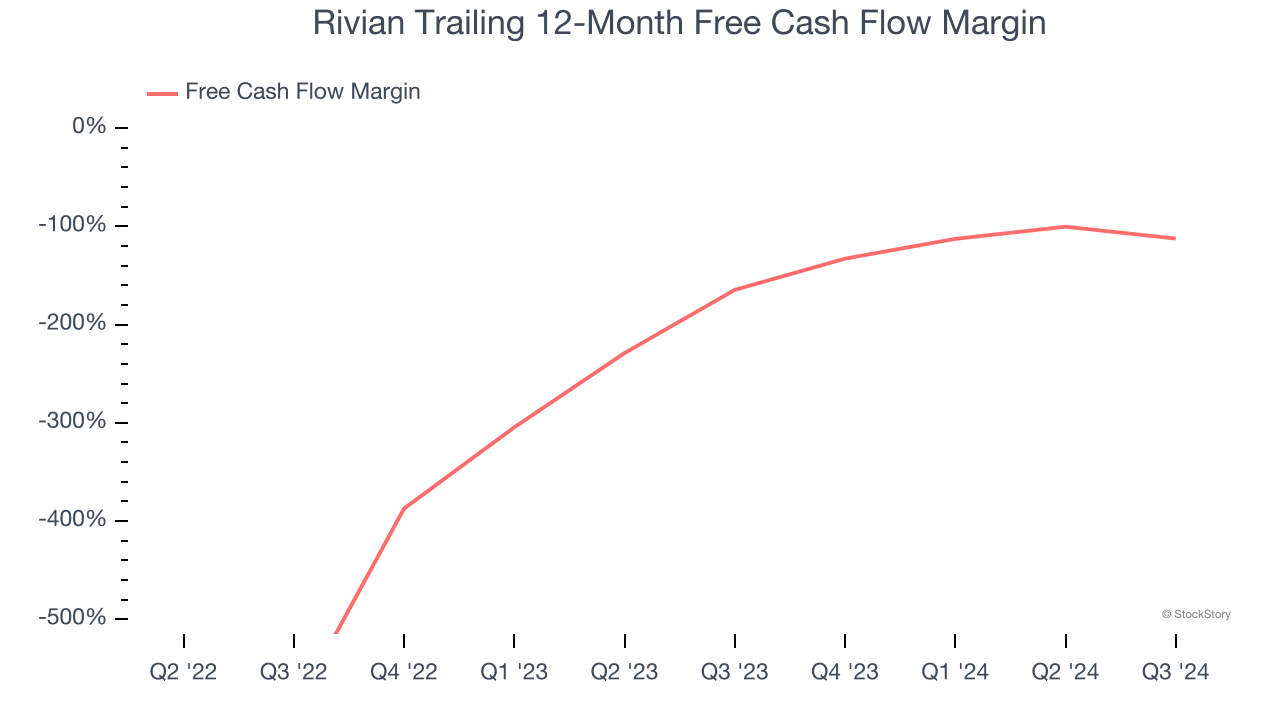

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Rivian’s demanding reinvestments have drained its resources over the last three years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 200%, meaning it lit $199.51 of cash on fire for every $100 in revenue.

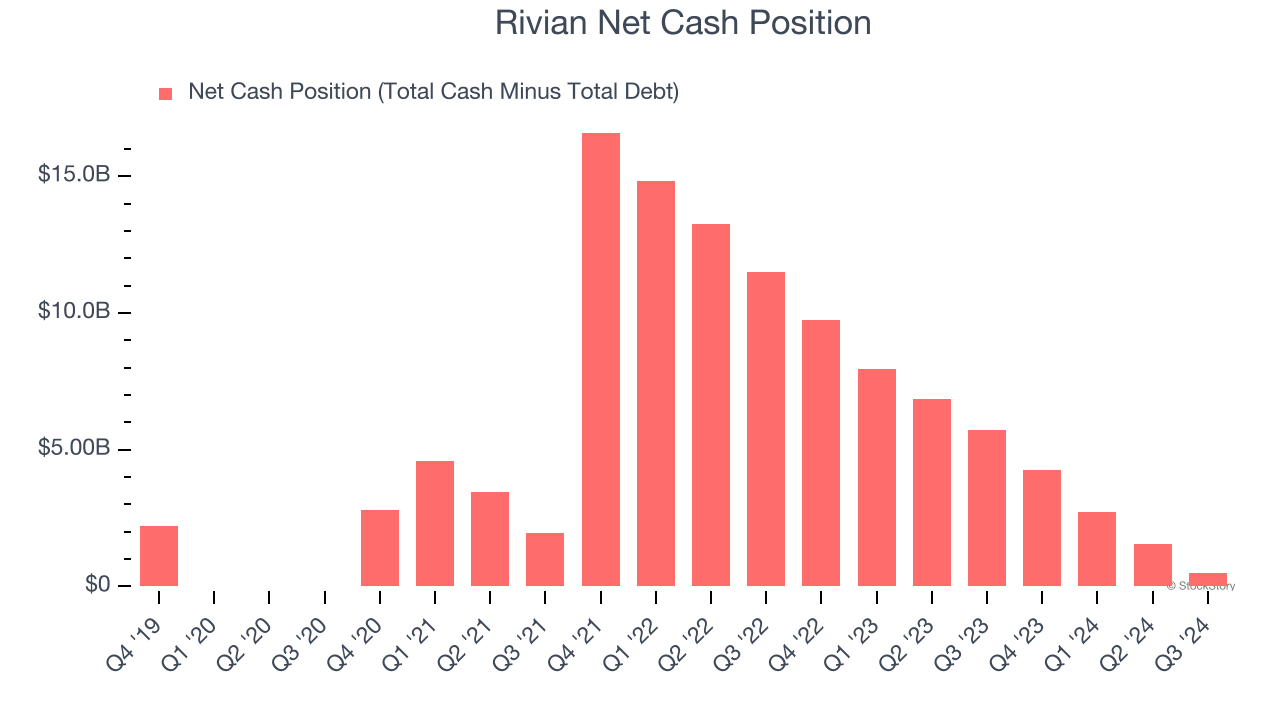

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Rivian burned through $5.12 billion of cash over the last year. With $6.74 billion of cash on its balance sheet, the company has around 16 months of runway left (assuming its $6.26 billion of debt isn’t due right away).

Unless the Rivian’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Rivian until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Rivian isn’t a terrible business, but it doesn’t pass our bar. With its shares trailing the market in recent months, the stock trades at $13.92 per share (or 2.9× forward price-to-sales). The market typically values companies like Rivian based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Rivian

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.