Even during a down period for the markets, Salesforce has gone against the grain, climbing to $274.18. Its shares have yielded a 6.7% return over the last six months, beating the S&P 500 by 8%. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Salesforce, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we're swiping left on Salesforce for now. Here are three reasons why CRM doesn't excite us and a stock we'd rather own.

Why Is Salesforce Not Exciting?

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information such as leads.

1. Long-Term Revenue Growth Disappoints

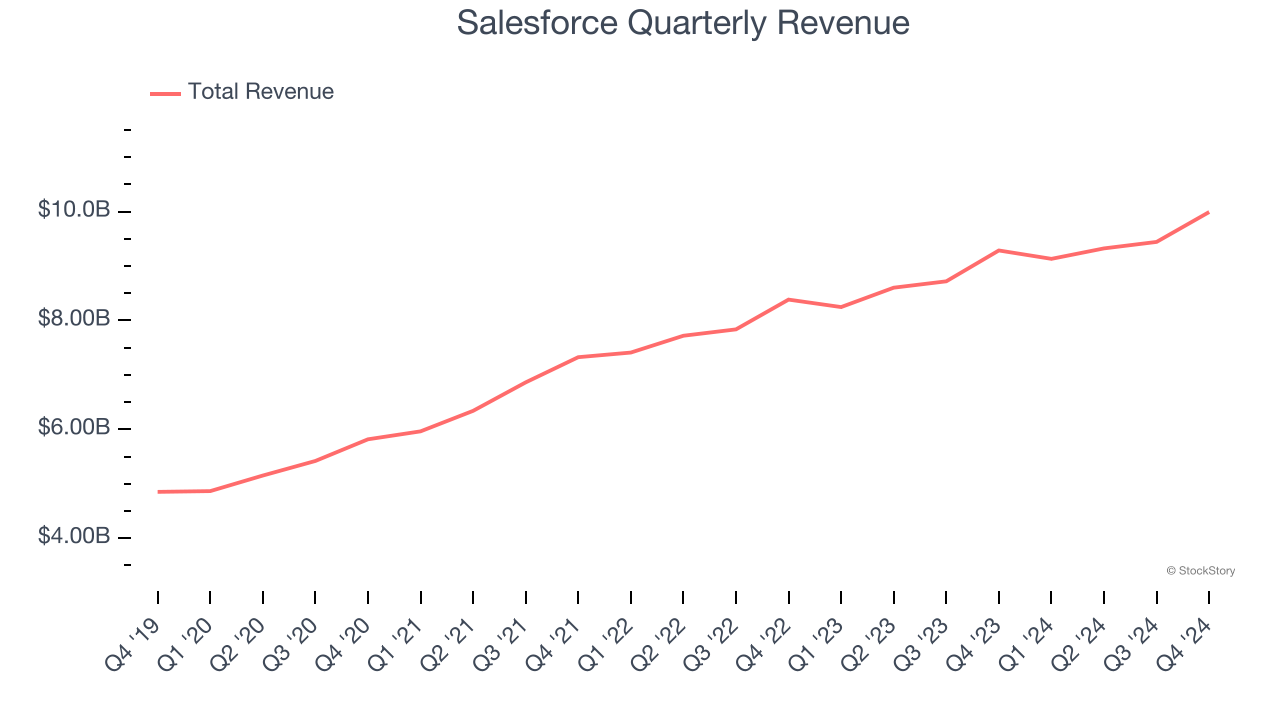

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Salesforce grew its sales at a 12.7% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Weak Billings Point to Soft Demand

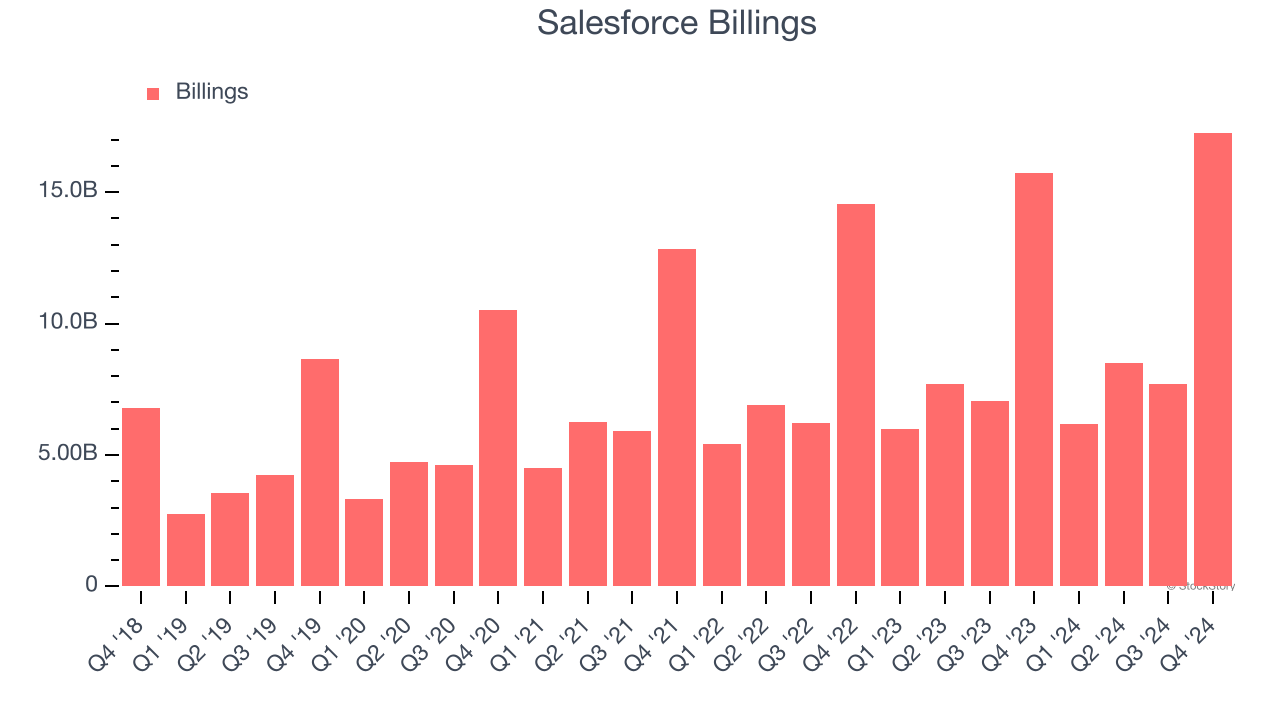

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Salesforce’s billings came in at $17.26 billion in Q4, and over the last four quarters, its year-on-year growth averaged 8.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Salesforce’s revenue to rise by 7.7%, a deceleration versus its 12.7% annualized growth for the past three years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Final Judgment

Salesforce isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 6.5× forward price-to-sales (or $274.18 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than Salesforce

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.