Real estate franchise company RE/MAX (NYSE:RMAX) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 4.9% year on year to $74.47 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $72.5 million was less impressive, coming in 4.2% below expectations. Its non-GAAP profit of $0.24 per share was 35.2% above analysts’ consensus estimates.

Is now the time to buy RE/MAX? Find out by accessing our full research report, it’s free.

RE/MAX (RMAX) Q1 CY2025 Highlights:

- Revenue: $74.47 million vs analyst estimates of $73.53 million (4.9% year-on-year decline, 1.3% beat)

- Adjusted EPS: $0.24 vs analyst estimates of $0.18 (35.2% beat)

- Adjusted EBITDA: $19.29 million vs analyst estimates of $17.62 million (25.9% margin, 9.5% beat)

- The company reconfirmed its revenue guidance for the full year of $300 million at the midpoint

- EBITDA guidance for the full year is $95 million at the midpoint, in line with analyst expectations

- Operating Margin: 7.2%, up from 5.8% in the same quarter last year

- Free Cash Flow Margin: 5.3%, similar to the same quarter last year

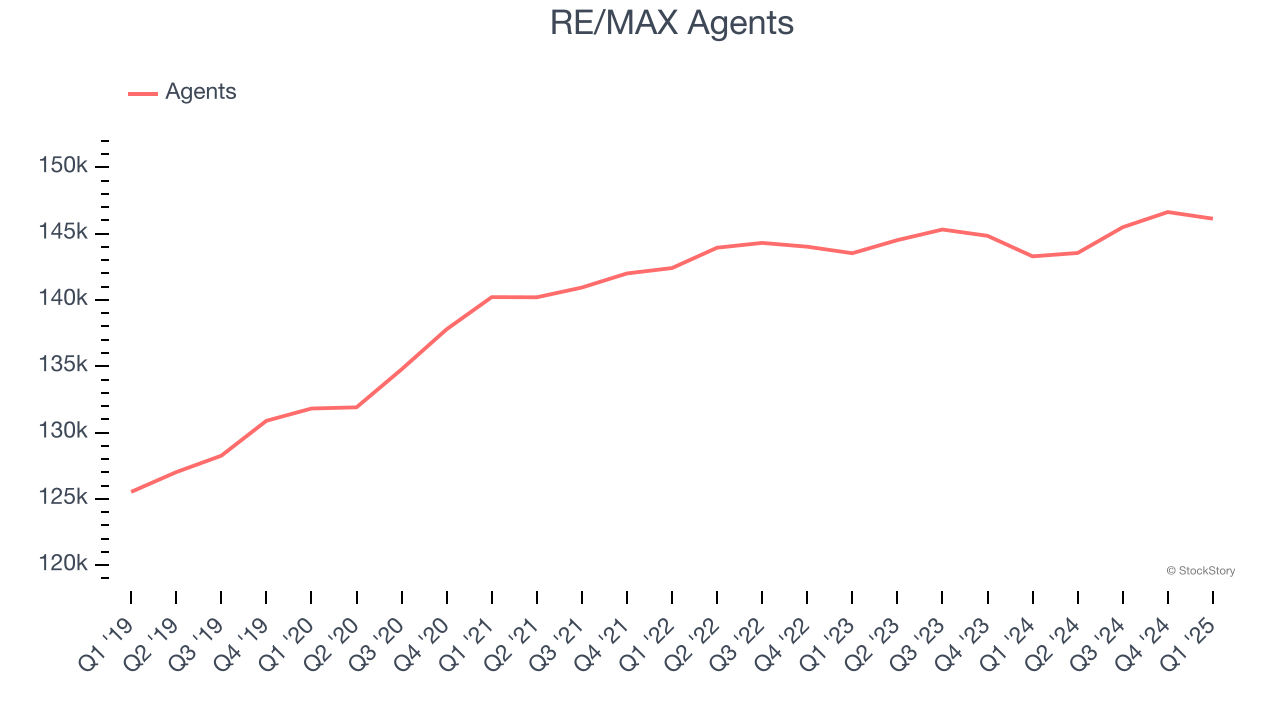

- Agents: 146,126, up 2,839 year on year

- Market Capitalization: $152.3 million

"For the fourth consecutive quarter, our company delivered solid profit and margin performance," said Erik Carlson, RE/MAX Holdings Chief Executive Officer.

Company Overview

Short for Real Estate Maximums, RE/MAX (NYSE:RMAX) operates a real estate franchise network spanning over 100 countries and territories.

Sales Growth

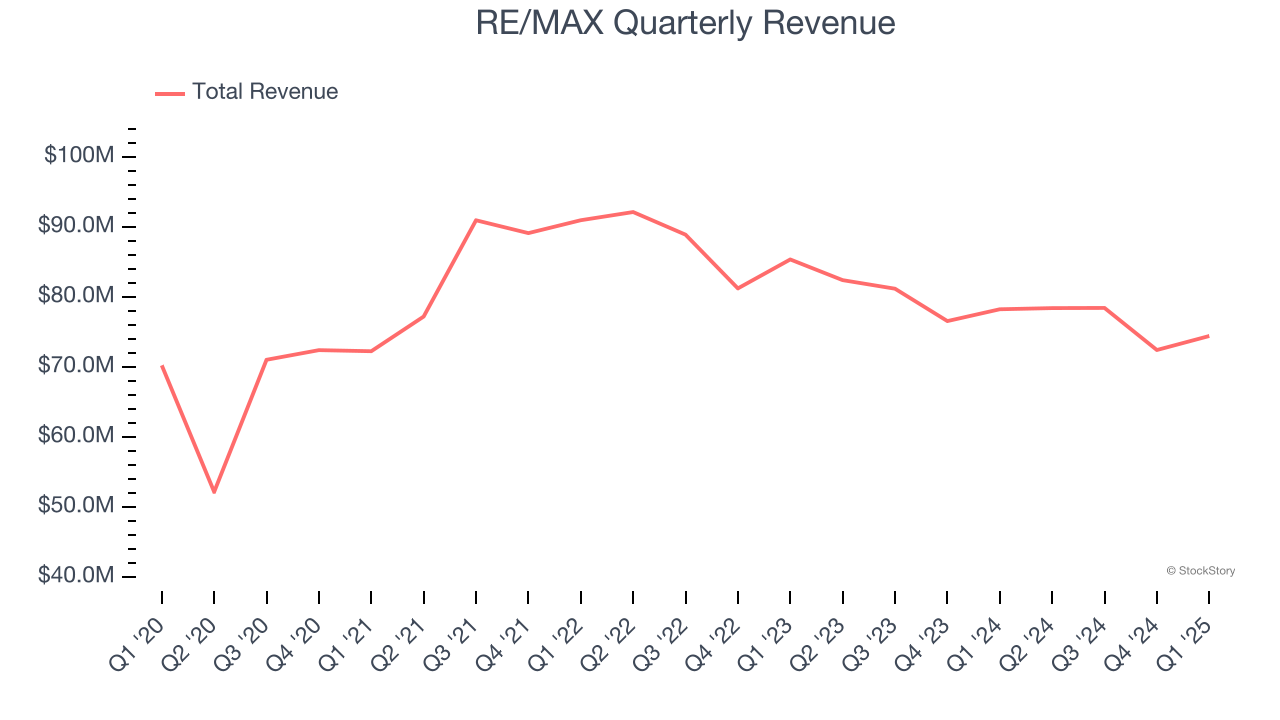

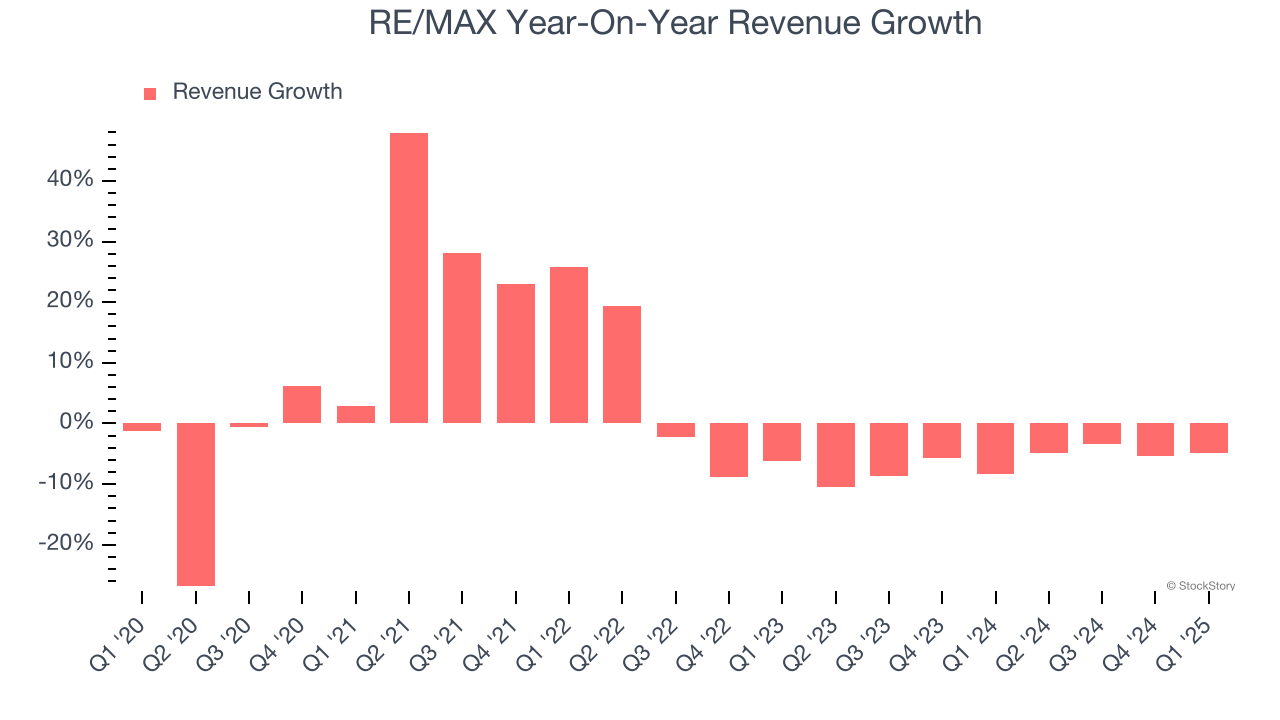

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, RE/MAX grew its sales at a weak 1.5% compounded annual growth rate. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. RE/MAX’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.5% annually.

RE/MAX also discloses its number of agents, which reached 146,126 in the latest quarter. Over the last two years, RE/MAX’s agents were flat. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, RE/MAX’s revenue fell by 4.9% year on year to $74.47 million but beat Wall Street’s estimates by 1.3%. Company management is currently guiding for a 7.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.3% over the next 12 months. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

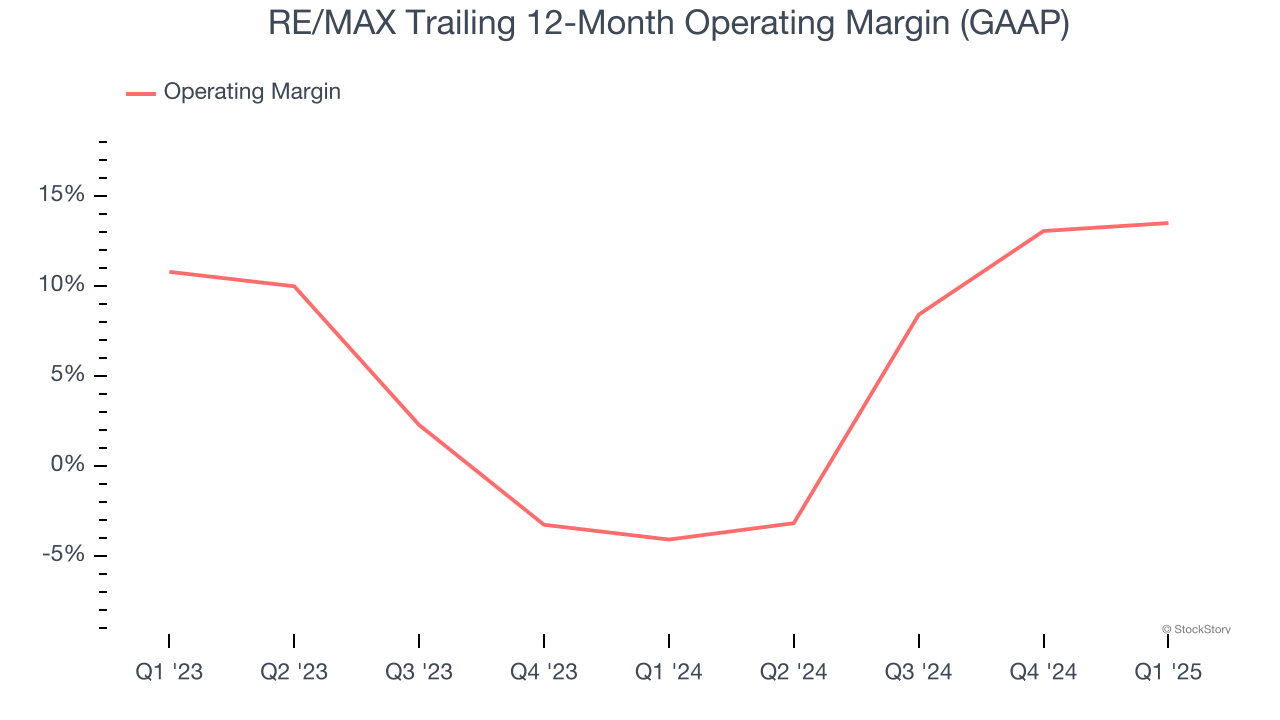

Operating Margin

RE/MAX’s operating margin has been trending up over the last 12 months and averaged 4.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q1, RE/MAX generated an operating profit margin of 7.2%, up 1.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

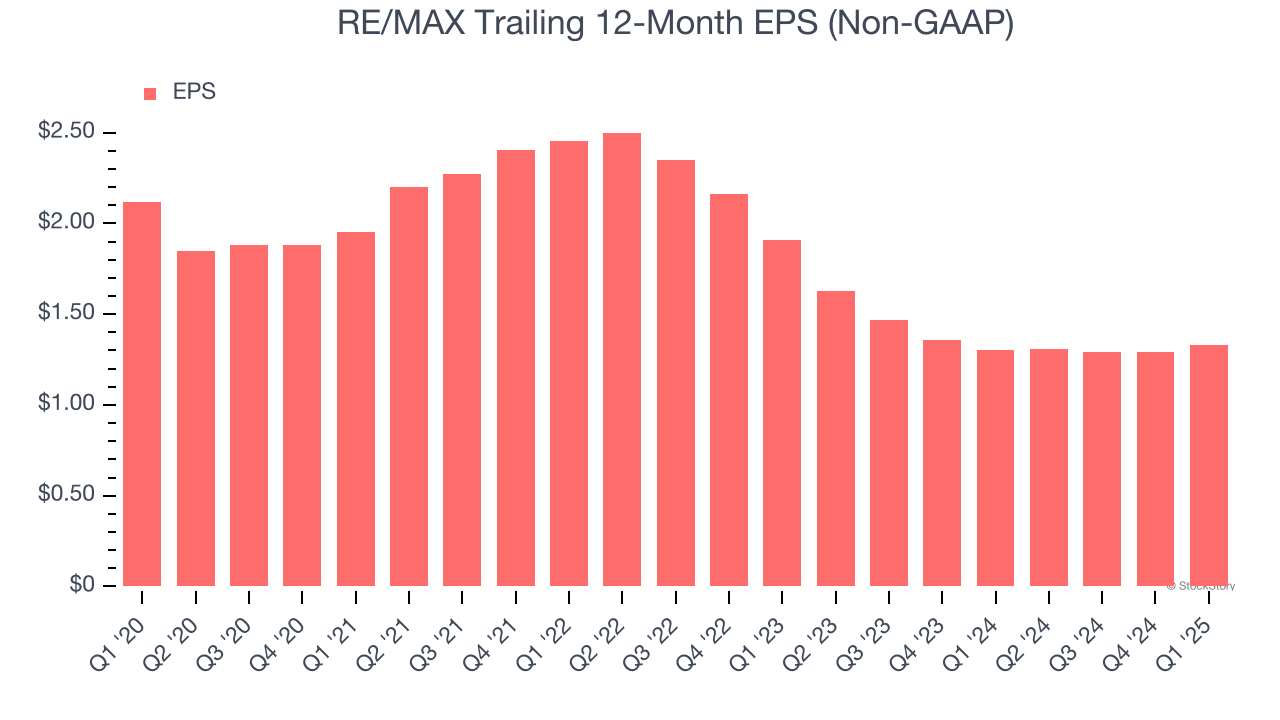

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for RE/MAX, its EPS declined by 8.9% annually over the last five years while its revenue grew by 1.5%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q1, RE/MAX reported EPS at $0.24, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects RE/MAX’s full-year EPS of $1.33 to shrink by 1.5%.

Key Takeaways from RE/MAX’s Q1 Results

We were impressed by how significantly RE/MAX blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 3.8% to $8.10 immediately after reporting.

Big picture, is RE/MAX a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.